Anti-Money Laundering and Know your Customer part 1

| What is Money Laundering? | ||

| Before we talk about Anti-Money Laundering first of all we need to discus about “What is Money Laundering?????” | ||

| Money Laundering is the process by which money derived from criminal activities (like drug trafficking, illegal arms sales, extortion, gambling etc.) is so brought into the financial system as to conceal its illicit origin (illegal source) and to make it appear to be from licit origin(legal source).** | ||

| Process of Money Laundering:- | ||

| Placement ----> Layering--->Integration | ||

| Placement: Deposited dirty money in a Bank or in a Financial institution its called PLACEMENT. Layering:- Dirty or Illegal Money which was deposited in a bank or financial institution, now transferred different banks including foreign or offshore bank for hiding the origin of the money. This process is called LAYERING. Integration:- Dirty money which was transferred different offshore banks now back to our system as investment as clean money, its called INTEGRATION. | ||

Money Laundering Process. | ||

| Money Laundering and Impact on Global Economy: | ||

| 1. Main concern of money laundering arises from its connection with the criminal activities or broadly speaking terrorist financing . Money laundering provides the way to criminal to convert illegal money or dirty money to legal or clean money. 2. Money laundering adversely impact on Economy. In investment market an unfair Competition created between honest and dishonest business man. Infusion illegal Money in market causes the distortion of price. Hard to control monetary situation. 3. Social and Political effect - Money laundering also adversely effect in Social and Political society. Due to illegal money corruption increased in society. 4. Effect on Banking Sector- Willingly or unwillingly the main transformation medium or intermediaries of dirty money is banking or financial institutions. So connection with criminals and money laundering would push them into adverse publicity. | ||

Online Video Lecture about Anti-Money Laundering and Know Your Customer Part 1 in Hindi follow YouTube Link BelowYouTube Link for Anti-Money Laundering and Know your Customer part 1 | ||

| Terrorism Financing: | ||

| It has two dimensions – one funds need to carry out some specific terrorist Action and two run the terrorist organization.For the first case required amount is very low and it could be transfer through Normal bank account of innocent people who are not aware of the act or by cash. It is very hard to notice.For the second case its needs huge funds. All countries governments are making Policies and law to break the money supply chain between the economy system and Terrorist organization. | ||

| Principle Sources of terrorist financing :- | ||

| 1. State financing: When any state supply funds to terrorist organization in form of grants or indirectly as donations. 2. Legitimate Modes: Contribution or donation received from businesses,Individuals or charity funds for their declared activities. 3. Private Funding: This type of funds raised through criminal activates like Bank robberies, kidnapping, extortion, drug trafficking etc. | ||

| Methods or mode of Money Laundering:- | ||

| 1. Smurfing / Deposit Structuring: Every countries have its own policies for reporting minimum cash deposited. In India this amount is 10 Lake, so the amount deposited by them would be such that they do not cross this amount. For handle huge amount they use numbers of accounts instead of 1 or 2 accounts. 2. Multiple Tier of Accounts: The funds are passed through more accounts even cross border for making the origin of the money untraceable. 3. Funnel Accounts: Several person deposited money in one account from different Branch below the threshold limits. 4. Contra transaction : Huge turn over in accounts without any business purpose. Money Transfer from this account and again from other accounts same amount of money deposited. 5. Money Mules: When terrorist use existing account of individuals not connected with Them by paying commission its called money mules. 6. Other methods are Bank Drafts, Cash Deposit followed by transfer, Connected or relatives Accounts, Front Companies, Dormant accounts, Wire transfers, Hawala System etc. | ||

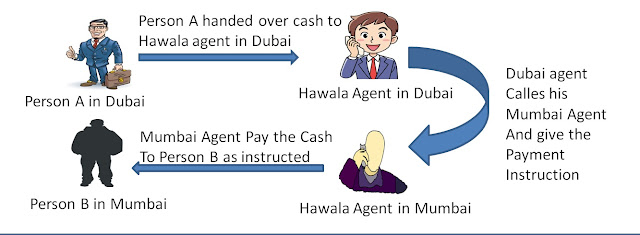

| Hawala System:-Alternative remittance system (mainly cross border) out side of the government control. | ||

| How its works? Let’s think a Person A from Dubai wants to transfer money to a Person B in Mumbai via Hawala. Person A contact Hawala agent in Dubai and give him Money to transfer to Person B. Hawala Agent in Dubai called his/her Mumbai Agent and gave instruction to give money to Person B as instructed by Person A. Hawala Agent in Mumbai handed over money to Person B. | ||

Hawala Process. | ||

| Please Visit My Facebook Page: BankTheory | ||

Next Part (AML and KYC Part 2) |

Comments