ANTI MONEY LAUNDERING AND KNOW YOUR CUSTOMER (AML AND KYC) PART 2

| Anti Money Laundering and Know Your Customer Part 2 (Agency, Government Body and Law) | ||||||||||||||||||

| The Financial Action Task Force (FATF): FATF is a inter-government body was established at the G-7 economic summit held in Paris in 1989. | ||||||||||||||||||

| Focus area of FATF 1. Identifying and analysing threats to the integrity of the international financial system. 2.Developing and refining international standards for combating money laundering and the financing terrorism. 3.Identifying and engaging with high risk and non-cooperative jurisdictions. 4.Assessing and monitoring how well members have implemented the FATF recommendation FATF have 40 general recommendations and 9 special recommendation. | ||||||||||||||||||

| To Understand AML and KYC Part 2 in HINDI, Visit My YouTube Channel or Click on Link Below: | ||||||||||||||||||

| YouTube Link for ANTI MONEY LAUNDERING AND KNOW YOUR CUSTOMER (AML AND KYC) PART 2 in Hindi | ||||||||||||||||||

| Financial Intelligence Units (FIU): FIU is the agency who collected, analyzed and disseminate financial information to combat money laundering and terrorist financing. In the year 2003 while reviewing FATF 40 recommendations included establishment and functioning of FIUs. | ||||||||||||||||||

| Main objectives of setting FIUs are as follows: 1. Law and enforcement agencies have limited access to financial information 2. To engaged the financial system to combat money laundering 3. To report suspect financial transaction by financial institution to central agency for accessing and processing reports. | ||||||||||||||||||

| Prevention of Money Laundering Act,2002 (PMLA) To prevent money Laundering and financing in Terrorism India enacted Prevention of Money Laundering Act,2002, it was enacted in the year 2003 and implemented 1st July 2005. | ||||||||||||||||||

| Corrective or Punitive Action against financial institution for non compliance of the act- as per Section 13 of the PMLA act.1. Issuance of warning 2. Asking for take remedial actions 3. Asking to report to the Directors, FIU remedial taken Monetary Penalty – Minimum ₹ 10,000 and Maximum ₹ 1,00,000 | ||||||||||||||||||

| Offence of Money Laundering | ||||||||||||||||||

| Definition as per Section 3 of the act:- “Whosoever directly of indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime including its concealment, possession, acquisition or use and projecting or claiming it as untainted property shall be guilty of offence of Money Laundering”. 1. An offence under the PMLA act is cognizable* and non- bailable. | ||||||||||||||||||

| Punishment for the offence under PMLA: As per section 4 of the PMLA,2002 Imprisonment for Minimum 3 years and maximum 7 years and shall also be liable to fine. PMLA has an overriding effect above any other statute. | ||||||||||||||||||

| Organisation structure in India for AML/CFT | ||||||||||||||||||

| Ministry of Finance-FATF Cell: A distinct FATF cell is functioning under the Department of Economic Affairs in the Ministry of Finance. This cell handles all the task in respect of implementation of PMLA. FIU-IND: Financial Intelligence Unit-India was established in November 2014 Under the Department of Revenue in the Ministry of Finance. | ||||||||||||||||||

| FIU-IND and International Association: | ||||||||||||||||||

| India become Member of FATF (Financial Action Task Force) in 2010 India become member of EAG (Eurasian Group on Combating Money Laundering and Financing of Terrorism) in 2010 India become member of APG (Asia Pacific Group on Money Laundering) in 1998 India become member of Egmont Group in 1998 and one of the two regional Representative of Asia region along with Qatar. | ||||||||||||||||||

| More about FIU-IND: | ||||||||||||||||||

| Technology Initiatives: FIU-IND uses “FINnet” for online reporting purpose. For processing of report FIU-IND uses “FINCore”. Reporting entities like Bank or other financial institute uses “FINgate” Portal to report to the FIU-IND | ||||||||||||||||||

| Report to FIU-IND: | ||||||||||||||||||

| ||||||||||||||||||

| Other Government Bodies working with FIU-IND | ||||||||||||||||||

| 1. ED (The Directorate of Enforcement) It was established in 1956 under the control of Department of Revenue in the Ministry of Finance and responsible for enforcement of FEMA ,1999 and PMLA 2002. 2. SIFO (Serious Frauds Investigation Office): It was setup under Ministry of Corporate Affairs for prosecution white-collar crimes or fraud**. 3. NIA (National Investigation Agency) It was CFT (Combating Financial Terrorism) related set-up under NIA act 2008. NIA is Functioning as the Central Counter Terrorism Law enforcement agency in India. | ||||||||||||||||||

| Correspondent Bank, Shell Bank and Country Risk | ||||||||||||||||||

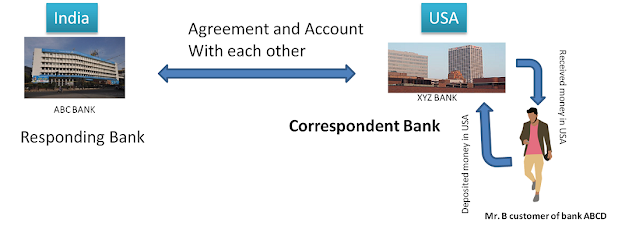

| Correspondent Bank: Correspondent banking is the banking facilities provided by one bank to another bank. Corresponding services including cash or fund management, Wire transfer, loan arrangement, cheques, Demand Draft clearing, LC issuing etc. | ||||||||||||||||||

| CORRESPONDENT BANKING | ||||||||||||||||||

| Shell Bank : A shell Bank is a bank which is incorporated in an country where it has no physical Presence or not affiliated to any regulated financial group. Its also called Paper Bank. Shell Banks are not permitted in India and also not permitted to set up any correspondent Relationship with shell banks or banks who permit their accounts to be used by Shell Banks. | ||||||||||||||||||

| Country Risk: There are several countries that have not accepted the international norms for AML/CFT And some countries who adopt but not use in high degree. So Money Launderers routing Their money through above countries and its hard to trace the money tails by the AML/CFT agencies . | ||||||||||||||||||

| FATF Publication about High Risk Jurisdiction: | ||||||||||||||||||

| FATF publication have 88 High-risk and other monitored jurisdictions. Other monitored Jurisdiction who have deficiencies in application of AML/CFT- Our neighbor countries Myanmar and Pakistan take place on the list. High-Risk Jurisdictions subject to a Call for Action – 30 June 2020 Iran and North Korea are in the list of Call for Action, it means Iran and North Korea are the most dangerous countries in the view of country risk perception. | ||||||||||||||||||

| ---- End of AML PART of AML and KYC ----- | ||||||||||||||||||

| AML and KYC Part 1 | ||||||||||||||||||

| Next Part 3 all about KYC | ||||||||||||||||||

*Cognizable means : arrest without a warrant. Back to Main Paragraph** White-collar crime or fraud, crime or fraud committed by persons who, often by virtue of their occupations, exploit social, economic, or technological power for personal or corporate gain.More accurately refers to financially motivated, nonviolent crime committed by businesses and government professionals.(sources ENCYCLOPEDIA BRITANNICA and WIKIPEDIA). Back to Main Paragraph |

Comments